A retailer is always aiming for a profitable balance between the volume of sales and the amount of inventory in store. you must also use an accounting method that clearly reflect income. In this case, you can use the cash method of accounting.

#1 Product Merchandising:

Which of the following is included in the operating cycle of a merchandising company?

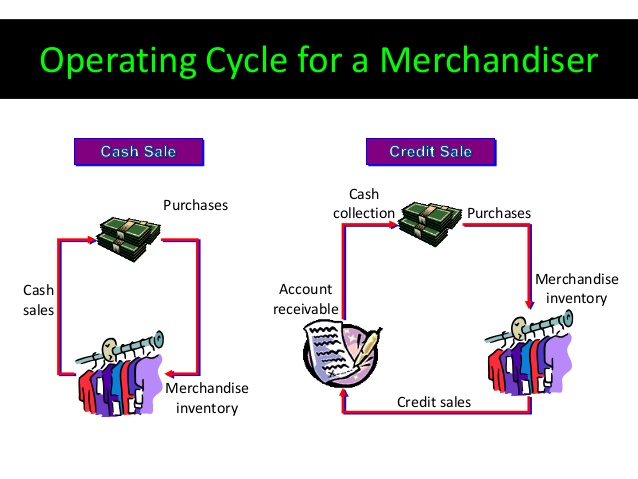

Operating Cycle for a Merchandiser A merchandising company’s operating cycle begins by purchasing merchandise and ends by collecting cash from selling the merchandise. Companies try to keep their operating cycles short because assets tied up in inventory and receivables are not productive. 1.

Since we need the cost of goods sold to calculate the net income, we will figure it first. A total of 85 prints were sold during this time period. Using the FIFO method, what is the value of the prints still left in stock? To calculate this, we assume that the first 85 were already sold, so that would leave 15 prints in stock from the June 19th purchase date. Since they were purchased at $3.30 each, then the inventory value that would be recorded for the prints is $49.50.

Let us look at the business model of a supermarket or hypermarket chain. The customers who come to purchase pay by cash and hence there aren’t any debtors or the collection period is 0 days.

Third, some of the cash from the inventory sales is used to purchase more inventory. This is probably the most important part of the entire cycle.Controlling inventory turnoveris extremely important for all merchandisers. Buying too much could lead to cash flow shortages and buying too much can create dissatisfied customers. Managers usually use the merchandise purchases budget to help make buying decisions. First, the merchandiser purchases products to sell to customers.

But first, we need to look at inventory, because FIFO and LIFO are ways of keeping track of inventory for cost of goods sold calculations. The working capital cycle focuses on management of 4 key elements viz. cash, receivables (debtors), payables (creditors) and inventory (stock). A business needs to have complete control over these four items in order to have a fairly controlled and efficient working capital cycle. Let us look at an example to enable a better understanding of the concept of working capital cycle.

Along with deciding what type of system to use to keep up with the amount of inventory that a company has, the decision also has to be made on how to value that inventory. One method commonly used is called FIFO, which is short for First In, First Out. In this type of valuation, you assume that the first items that are added to inventory are the first ones sold. Another method is the LIFO method, short for Last In, First Out.

Since inventory is something that a business owns, it is considered an asset and reported as such on the balance sheet. The dollar value that corresponds to the inventory account depends on the valuation method that’s used. E-commerce stores should have a simple layout and an effective search tool for customers to browse through the store effortlessly. Software has advanced to the point where a simple mouse rollover of an item activates a pop-up window displaying the product details and even multimedia demonstrations of how to use the product.

As inventory is sold, the cost of the inventory is expensed as cost of goods sold on the income statement. Inventory that was sold during the period remains on the balance sheet as a current asset.

Selling means that someone buys a good from you in exchange for cash. The amount of time that exists between the purchase of the item and the sale of the same item is called the operating cycle. What’s the cost of goods sold and the net income for Gifts Galore during this accounting period?

#5 Digital merchandising:

Merchandising is the arrangement of products in a physical or online store to maximize sales. The objective of merchandising is to close the sale after advertising campaigns bring customers into the store. Good merchandising frees up time, makes the selling process simpler, enhances the buying experience for consumers and drives sales growth.

These products are recorded to themerchandise inventoryaccount with a debit when they are purchased. Since most merchandisers have to purchase their inventory from other companies, there is a standard operating cycle that takes place every period. Depending on the type of business, the merchandiser operating cycle can occur once an accounting period or several times.

A person responsible for ensuring goods is in the right stores, or online at the right time and the right price. They analyze data to set selling prices and plan promotions and price reductions. In short, they maximize sales and profits whilst minimizing stock and costs. One of the common responsibilities of retail merchandising is helping visual merchandisers to make a plan of store layout.

- Both of these businesses are merchandising companies.

- A merchandising company is a company that buys goods and then resells them, generally for a higher price than they were purchased.

That is customer is pleased as he gets product of his desire and retailer gets profit as merchandise is sold. Merchandisers are “image consultants for the retail world.” Retailers use merchandising to promote specific products and services and increase sales. You may also see brochures and coupons at the register that encourage you to return to the store and buy again.

In this method, the assumption is that the last items added to inventory are the first items sold. In order for a merchandising company to operate, there are certain activities that must take place. The first thing that has to be done is purchasing. Purchasing means that you buy a good from someone in exchange for cash.

Working Capital cycle (WCC) refers to the time taken by an organization to convert its net current assets and current liabilities into cash. It reflects the ability and efficiency of the organization to manage its short-term liquidity position. If you’re trying to determine whether you want to be a merchandising business or a service business, you need to closely examine your end goal. Do you plan to offer a product for your customers, or are you focused on providing a service?

There are two types of merchandising companies – retail and wholesale. Basic merchandising techniques include displaying related merchandise together, simple and clean displays, ample aisle space, well-stocked shelves and prominent featuring of promotional items. For example, a furniture store may create a mock living room with different pieces of furniture items and fixtures to generate sales in these products. Attractive floor displays of seasonal goods in high-traffic areas also drive higher sales and profits. The National Retail Hardware Association recommends storing slow-moving and low-priced items away from customers to encourage sales of high-margin items.

Various costs are incurred by both merchandising and service businesses. Both may hire employees; both may need equipment to be in business; both types of business structures have customers who pay for goods or services. The main difference between a merchandising company and a service industry company is that the merchandising company must stock inventory.

Both of these businesses are merchandising companies. Do you know what I mean when I use the term merchandising company? A merchandising company is a company that buys goods and then resells them, generally for a higher price than they were purchased.

If the working capital cycle is too long, then the capital gets locked in the operational cycle without earning any returns. Therefore, a business tries to shorten the working capital cycles to improve the short-term liquidity condition and increase their business efficiency. A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other.

This becomes important when setting up the accounting for the business. Her warehouse acts as a supplier to a number of different retail stores, so it is a much bigger company than Kayleigh’s. Because of the importance of keeping items in stock for her customers, Lilly has created a department that is solely in charge of purchasing. Her purchasing manager, Jill, decides on the items that need to be purchased and fills out a purchase requisition for the items. She turns that requisition over to Lilly, who then approves or denies the requisition.

Merchandising strategies that you can use to improve sales:

Upon approval, Jill orders the merchandise and makes sure that upon receipt everything is as ordered. Under the perpetual system, there are continual updates to the cost of goods sold account as each sale is made. In the latter case, this means it can be difficult to obtain a precise cost of goods sold figure prior to the end of the accounting period. Under the perpetual system, there are continual updates to either the general ledger or inventory ledger as inventory-related transactions occur. It means store or buy that product that be sold is the basic philosophy of merchandising, which benefits both the customer and also the businessmen.

Which of the following statements regarding inventory are true? Costs included in the inventory account include only the amounts paid to acquire the asset.

The business is a supermarket and hence, all items in the store are taken from vendors and have a credit period availability to be paid. So usually such businesses enjoy the huge cash and even may make interest earning on the cash till the money needs to be paid to the suppliers. Therefore, these companies have a negative working capital cycle. In other words, the working capital cycle (calculated in days) is the time duration between buying goods to manufacture products and generation of cash revenue on selling the products. The shorter the working capital cycle, the faster the company is able to free up its cash stuck in working capital.

What is Merchandising: Types, Advantages, and Disadvantages

Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses. Sales Revenue is a revenue account and Cost of Goods is an expense account reported on the income statement. Cash, Accounts Receivable, and Inventory are current assets reported on the balance sheet.

Inventory is reported as a current asset on the balance sheet. Costs included in the inventory account include the amounts paid to acquire the asset and prepare it for sale. As inventory is sold, the cost of the inventory is transferred from the balance sheet to the income statement and is reported as an expense known as Cost of Goods Sold. Inventory that has not been sold at the end of the period, the ending inventory, remains on the balance sheet as a current asset.