Premium on Bonds Payable with Straight-Line Amortization

Premium generally arises when a fixed income security is purchased for an amount greater than the total of all amounts payable on the bond other than qualified stated interest. These rules apply to securities issued at par and to OID securities acquired on the secondary market at price greater than their maturity value. Fidelity calculates amortized premium (and makes corresponding adjustments to the cost basis it provides) using the yield-to-maturity method. For tax-exempt securities, amortization of premium is required and is not deductible from taxable income.

The acquisition premium amounts and adjusted cost basis Fidelity provides may not reflect all adjustments for tax reporting purposes. Review prior calculations and adjustments you have made and consult your tax advisor and IRS Publication 550, Investment Income and Expenses, for additional information. There are various rules and elections available for the treatment of market discount on your return, each of which may result in a different tax result. These rules only apply to fixed income securities issued with more than one year to maturity. Under this election, no market discount is recognized if the bond is sold at a loss.

Other elections available under tax laws may be more beneficial, depending on your individual tax situation. For Federal tax purposes, market discount income from both taxable and tax-exempt bonds is treated as taxable interest income. For example, a business may owe $1,000 in income taxes when calculated using accounting standards. However, if upon filing, the company only owes $750 on the income tax return, the $250 difference will be a liability in future periods. The conflict occurs because rule differences between the Internal Revenue Service (IRS) and generally accepted accounting principles (GAAP)cause the deferral of some liability for a future period.

Upon completing a federal income tax return, a business knows the actual amount of taxes owed. The amount of taxes owed is reflected as a tax liability. The taxes, based on the tax law of the company’s home country, are calculated on their net income. The taxable rate is according to its corporate tax rate.

AccountingTools

For companies, which are due a tax credit from its taxing agency, the amount of income tax payable will decrease. Income tax payable is shown as a current liability because the debt will be resolved within the next year.

However, any portion of income tax payable not scheduled for payment within the next 12 months is classified as a long-term liability. Those who invest in taxable premium bonds typically benefit from amortizing the premium, because the amount amortized can be used to offset the interest income from the bond. This, in turn, will reduce the amount of taxable income the bond generates, and thus any income tax due on it as well. The cost basis of the taxable bond is reduced by the amount of premium amortized each year.

For taxable bonds, a tax election may be required in order to amortize premium, and the current years amortized premium may be deductible from taxable income. The amortized premium amounts and adjusted cost basis Fidelity provides may not reflect all adjustments necessary for tax reporting purposes. It may not be applicable if you have not made an appropriate tax election or if you are using an alternative amortization calculation method. Review prior adjustments that you have made, and consult your tax advisor and IRS Publication 550, Investment Income and Expenses, for additional information.

A typical example of different results is when a company depreciates its assets. GAAP allows for numerous different methods of depreciation that all typically result in different expense amounts by the period. The IRS tax code, however, has more stringent rules pertaining to acceptable depreciation methods.

Example of Bonds Payable

- These rules apply to securities issued at par and to OID securities acquired on the secondary market at price greater than their maturity value.

- Fidelity calculates amortized premium (and makes corresponding adjustments to the cost basis it provides) using the yield-to-maturity method.

- Premium generally arises when a fixed income security is purchased for an amount greater than the total of all amounts payable on the bond other than qualified stated interest.

Income tax payable is one component necessary for calculating an organization’sdeferred tax liability. A deferred tax liability arises when reporting a difference between a company’s income tax liability and income tax expense. The difference may be due to the timing of when the actual income tax is due.

The calculation of income tax payable is according to the prevailing tax law in the company’s home country. General accounting principals and the IRS tax code do not treat all items the same. This variation in accounting methods may cause a difference between income tax expense and income tax liability because two different sets of rules govern the calculation. Businesses use GAAP to calculate income tax expense. This figure is listed on the company’s income statementand is usually the last expense line item before the calculation of net income.

The utilization of the two different depreciation methods creates a difference in the tax expense and tax liability. Income tax payable includes levies from the federal, state, and local levels.

Is premium on bonds payable an asset?

A liability account with a credit balance associated with bonds payable that were issued at more than the face value or maturity value of the bonds. The premium on bonds payable is amortized to interest expense over the life of the bonds and results in a reduction of interest expense.

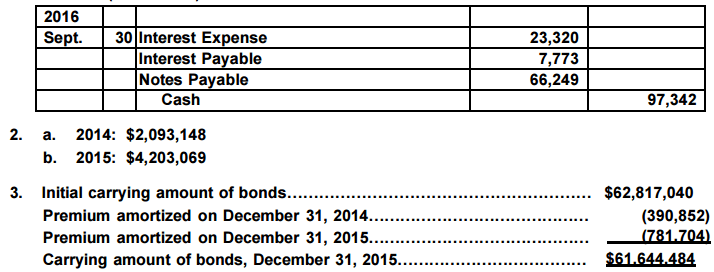

Let’s calculate the amortization for the first period and second period. The premium paid for a bond represents part of the cost basis of the bond, and so can be tax-deductible, at a rate spread out (amortized) over the bond’s lifespan. The amortizable bond premium is a tax term that refers to the excess price paid for a bond over and above its face value. Depending on the type of bond, the premium can be tax-deductible and amortized over the life of the bond on a pro-rata basis.

Where is premium on bonds payable on balance sheet?

Premium on bonds payable is the excess amount by which bonds are issued over their face value. This is classified as a liability, and is amortized to interest expense over the remaining life of the bonds. The net effect of this amortization is to reduce the amount of interest expense associated with the bonds.

For a bond investor, the premium paid for a bond represents part of the cost basis of the bond, which is important for tax purposes. If the bond pays taxable interest, the bondholder can choose to amortize the premium—that is, use a part of the premium to reduce the amount of interest income included for taxes. This amortization will impact the taxable income you will recognize each year. If you elected an alternative amortization calculation method, the acquisition premium amount Fidelity calculates may not be applicable.

Bonds Payable Outline

Income tax payable is one component necessary for calculating an organization’s deferred tax liability. Income tax payable is found under the current liabilities section of a company’s balance sheet. For example, consider an investor that purchased a bond for $10,150. The bond has a five-year maturity date and a par value of $10,000. It pays a 5% coupon rate semi-annually and has a yield to maturity of 3.5%.

In a case where the bond pays tax-exempt interest, the bond investor must amortize the bond premium. Although this amortized amount is not deductible in determining taxable income, the taxpayer must reduce his or her basis in the bond by the amortization for the year. The IRS requires that the constant yield method be used to amortize a bond premium every year. Income tax payable is a type of account in the current liabilities section of a company’s balance sheet. It is compiled of taxes due to the government within one year.