However, instead of recording a credit entry directly in the owner’s capital account, the credit entry is recorded in the temporary income statement account entitled Service Revenues. Later, the credit balance in Service Revenues will be transferred to the owner’s capital account. When J. Lee invests $5,000 of her personal cash in her new business, the business assets increase by $5,000 and the owner’s equity increases by $5,000. As a result, the accounting equation for the business will be in balance. Since the balances of these accounts are set to zero (closed out) at the end of a period, these accounts are sometimes referred to as temporary or nominal accounts.

In accounting terms, a company’s equity balance represents its net worth and may be calculated as a company’s total assets minus its total liabilities. The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business.

Is owner’s capital an asset?

What Does Owners’ Capital Mean? Basically, the owner’s capital account represents the net assets of the company. It’s the amount of money left over after the company sells all of its assets and pays off all of its creditors. This remaining amount of money is what the owner actually owns.

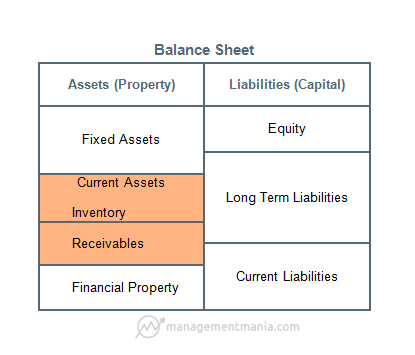

It is a snapshot at a single point in time of the company’s accounts – covering its assets, liabilities and shareholders’ equity. The purpose of a balance sheet is to give interested parties an idea of the company’s financial position, in addition to displaying what the company owns and owes.

Likewise, if you have a decrease in assets or an increase in liabilities, the equity decreases. If this equity calculation does not produce the difference between your assets and liabilities, your balance sheet will not balance. There are 10,000 authorized shares, and of those, 2,000 shares have been issued for $50,000.

Long-term liabilities are debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet. Current liabilities are the company’s liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables, along with the current portion of longer-term borrowing, such as the latest interest payment on a 10-year loan. The balance sheet is a report that summarizes all of an entity’s assets, liabilities, and equity as of a given point in time.

At the end of each year, an accountant moves the company’s annual net income from the income statement over to the balance sheet’s retained earnings account, increasing total equity. A balance sheet, along with the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations.

Corporations decrease their total equity when they pay dividends to shareholders. Preferred stock often comes with quarterly or annual dividend payment obligations the company must fulfill.

Owner’s Equity vs. Company’s Market Value

Where does owner’s capital go on balance sheet?

The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business. It is obtained by deducting the total liabilities from the total assets. The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet.

Check the figures within your Stockholder’s Equity, or Owner’s Equity if the business is a sole proprietorship. The equity category is the equivalent of the difference between the assets and the liabilities. If your business has more assets than liabilities, your business has equity.

Companies looking to increase profits want to increase their receivables by selling their goods or services. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet. Assets, liabilities, and subsequently the owner’s equity can be derived from a balance sheet, which shows these items at a specific point in time. Business owners and other entities, such as banks, can look at a balance sheet and owner’s equity to analyze a company’s change between different points in time. It’s important to understand that owner’s equity changes with the assets and liabilities of the company.

It is obtained by deducting the total liabilities from the total assets. The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet. The owner’s equity is always indicated as a net amount because the owner(s) has contributed capital to the business, but at the same time, has made some withdrawals. Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses.

- Corporations decrease their total equity when they pay dividends to shareholders.

When equity decreases because of dividend payments, a few years of negative earnings for a start-up venture or one bad year of earnings because of an extraordinary event, it’s not generally a bad sign. Total equity can increase on the balance sheet whenever a company issues new shares of stock. If the company receives donations of capital from owners or other parties, this also increases total equity. One other common increase in total equity results from an increase in the company’s retained earnings.

Balance Sheet Outline

The total stockholders’ equity section is on the bottom of a corporation’s balance sheet. This section shows detailed accounts for common stock, preferred stock, treasury stock, paid-in capital, dividends paid and retained earnings. A company’s balance sheet, also known as a “statement of financial position,” reveals the firm’s assets, liabilities and owners’ equity (net worth). The balance sheet, together with the income statement and cash flow statement, make up the cornerstone of any company’s financial statements.

What is Owner’s Equity?

For the liabilities side, the accounts are organized from short to long-term borrowings and other obligations. These are the financial obligations a company owes to outside parties.

It is typically used by lenders, investors, and creditors to estimate the liquidity of a business. The balance sheet is one of the documents included in an entity’s financial statements. Of the financial statements, the balance sheet is stated as of the end of the reporting period, while the income statement and statement of cash flows cover the entire reporting period.

At the balance sheet date, the corporation had cumulative net income after income taxes of $40,000 and had paid cumulative dividends of $12,000, resulting in retained earnings of $28,000. For one, they appear on completely different parts of a company’s financial statements. Assets are listed on the balance sheet, and revenue is shown on a company’s income statement.

For example, if Sue sells $25,000 of seashells to one customer, her assets increase by the $25,000. The balance sheet, which shows the owner’s equity, is prepared for a specific point in time. As a result, it would show the assets, liabilities, and owner’s equity as of December 31. If a company performs a service and increases its assets, owner’s equity will increase when the Service Revenues account is closed to owner’s equity at the end of the accounting year.

The other part of the entry involves the owner’s capital account, which is part of the owner’s equity. Since owner’s equity is on the right side of the accounting equation, the owner’s capital account (which is expected to have a credit balance) is increased with a credit entry of $2,000.

If you are a shareholder of a company or a potential investor, it is important that you understand how the balance sheet is structured, how to analyze it and how to read it. Financial ratio analysis uses formulas to gain insight into a company and its operations. For a balance sheet, using financial ratios (like the debt-to-equity ratio) can provide a good sense of the company’s financial condition, along with its operational efficiency. It is important to note that some ratios will need information from more than one financial statement, such as from the balance sheet and the income statement. As you can see from the balance sheet above, it is broken into two main areas.

Assets are on the top, and below them are the company’s liabilities and shareholders’ equity. It is also clear that this balance sheet is in balance where the value of the assets equals the combined value of the liabilities and shareholders’ equity. Another interesting aspect of the balance sheet is how it is organized. The assets and liabilities sections of the balance sheet are organized by how current the account is. So for the asset side, the accounts are classified typically from most liquid to least liquid.

The payments directly reduce the company’s retained earnings in the stockholders’ equity section of the balance sheet, causing a drop in total equity. If a company experiences a net loss in any given year, this also reduces total equity when the year’s losses are transferred from the income statement to the balance sheet.

It is important that all investors know how to use, analyze and read a balance sheet. Shareholders’ equity is the initial amount of money invested in a business. In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders’ equity on the other side. Total equity represents the total money received from investors plus a corporation’s accumulated earnings. Put differently, total equity equals a firm’s assets minus its liabilities.