The dealer will be looking to sell the vehicle for a higher price than they paid for it, which may include the cost of any reconditioning work. Research the market value of your car and take that into consideration when you negotiate the trade in. An alternative to trading in is to sell your car privately, which will typically get you a higher price, although it requires more time and effort. In most states, local laws meant to streamline the business keep the trade-in prices low.

Before you begin negotiations, you should understand how the trade-in process works to avoid unpleasant surprises down the road. Regardless, the money can be deducted from the purchase price or added to your trade-in offer. The latter will be done if you still owe the bank more on yourr current vehicle than what you’ve been offered on trade. Ultimately, dealerships want your business, and they need to sell cars. For this reason, they’re generally ready to accept your trade-in and negotiate a fair price.

This requires recording it as an asset and the cost associated with the car. Then, as with all assets, the company must depreciate the value of car. For example, presume Company X buys a $20,000 car with a $5,000 down payment and a three-year $15,000 loan for balance.

The dealership uses the ACV when adding the car to its inventory books. Assets are presented on the balance sheet in order of their liquidity. Current assets, which are expected to be consumed or converted to cash within one year, are listed at the top.

Other states put a sales tax on the difference between the retail price of a new car and the trade-in value. This creates an incentive for consumers to trade in their old cars for new ones, thus making it easier for car dealers to persuade customers to consider a trade-in instead of selling privately. Figuring out how to divide your vehicles in a divorce is a little trickier than splitting cash accounts or household goods.

Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business.

Example of a Car Loan

If you are upside down on your car loan and the promise to clear off your debt sounds too good to be true, it probably is. One way or another, the dealership will add the difference between your car loan and the value of your old vehicle to the price of your next purchase. Keep in mind that if you can sell your used car yourself, you can keep more of the equity that disappears when you take a wholesale offer from an auto dealership. If you owe more on your old car than it is worth, your set of wheels has negative equity. In this case, the dealer will add the difference between the loan balance and the value of your trade-in to the price of your new car.

Vehicles, such as vans, are assets that will be used to produce money for the business over time. The accounting rules require us to record the cost to purchase the van over its useful life. This matches the cost to purchase the van to the income associated with the expense. It is a common practice to exchange a used PPE asset for a new one.

When you reach an agreement, you will calculate the difference you have to settle to get the new car and sign over the title of your old car to the dealership. To calculate the net cost of your new vehicle, the dealer will subtract the value of your old car from the price of the vehicle you want. If your 2012 Ford Focus is worth $6,000 and you negotiated the price of the 2017 model you are interested in down to $14,000, you will pay or make arrangements to finance the balance of $8,000. Many car dealerships accept trade-ins with vehicles that have not been paid off. Most of these dealerships even promise to pay off the balance on your auto loan.

Also referred to as PPE (property, plant, and equipment), these are purchased for continued and long-term use in earning profit in a business. They are written off against profits over their anticipated life by charging depreciation expenses (with exception of land assets). Accumulated depreciation is shown in the face of the balance sheet or in the notes. Companies use sales promotions to get customers to take action (make purchases) quickly.

Property (such as office space or buildings) and equipment are common long-term assets. Trade-in value is basically a car dealership’s valuation of your car when you opt for a trade-in. The amount is shown on the purchase contract, and is deducted from your new vehicle‘s price. However, there is a difference between trade-in value and what the vehicle is actually worth when sold in the market or as a cash asset to the dealer. The vehicle’s valuation from the dealership is known as the actual cash value (ACV).

Suppose, for example, that you still owe $8,000 on your 2012 Ford Focus. The dealer will take the car as a trade-in and add $2,000 ($8,000 loan balance minus $6,000 trade-in value) to the price of the new car you want. When you approach a car dealership and ask to trade in your car, a representative will test drive it, appraise its value, and make you an offer. You may want to use estimates from online pricing guides such as Kelley Blue Book to negotiate the value of your trade-in and the price of the car you want.

- Although physical assets commonly come to mind when one thinks of assets, not all assets are tangible.

- In financial accounting, an asset is any resource owned by the business.

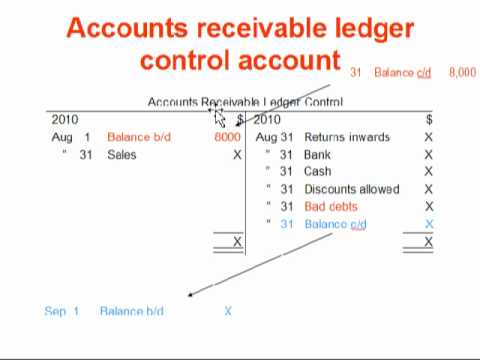

- Common asset categories include cash and cash equivalents; accounts receivable; inventory; prepaid expenses; and property and equipment.

Cash, short-term investments and inventory are examples of current assets. Since the price tag on the 2017 model is $14,000, you will pay or finance the balance of $10,000.

When you get to the stage of purchasing and financing your new car, the loan value is the amount of financing that the lender is willing to provide toward the purchase. This amount can depend on a number of factors including your financial stability, credit score, trade-in amount, down payment, and the conditions of any unfulfilled loan on your current car. Once you have agreed on a trade-in value with the dealer, a trade-in allowance should also be established. The allowance is the amount by which the dealer will reduce the cost of your new car as a result of trading in your old one. This is like a credit from the sale of your existing car that is put toward the purchase of your new vehicle.

START YOUR BUSINESS

Common asset categories include cash and cash equivalents; accounts receivable; inventory; prepaid expenses; and property and equipment. Although physical assets commonly come to mind when one thinks of assets, not all assets are tangible. In financial accounting, an asset is any resource owned by the business. Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset.

Inventory – trading these assets is a normal business of a company. The inventory value reported on the balance sheet is usually the historical cost or fair market value, whichever is lower. Long-term assets, or fixed assets, are expected to be consumed or converted to cash after one year’s time, and they are listed on the balance sheet beneath current assets.

Accounting Entries for the Purchase of a Vehicle

The car payments will be $500 each, with $416.67 going towards the principal on the loan and $83.33 of interest each payment. When you trade in an old car for a new model and add cash to the deal, the cash you pay is the boot. The base amount of the exchange remains tax-deferred, but the boot is considered a taxable gain. Even with the boot, however, the recipient will pay less in capital gains taxes for the current tax year than if he had sold the appreciated property and then purchased a different property. Parties will often engage in like-kind transactions in order to avoid or minimize the tax consequences of selling an appreciated asset.

What is trade in allowance in accounting?

It is a common practice to exchange a used PPE asset for a new one. This is known as a trade-in. The value of the trade-in agreed by the purchaser and seller is called the trade-in allowance. This amount is applied to the purchase price of the new asset, and the purchaser pays the difference.

The value of the trade-in agreed by the purchaser and seller is called the trade-in allowance. This amount is applied to the purchase price of the new asset, and the purchaser pays the difference. For instance, if the cost of a new asset is $10,000 and a trade-in allowance of $6,000 is given for the old asset, the purchaser will pay $4,000 ($10,000 – 6,000). Many car dealerships promise to pay off your trade-in, but they only mean it if your old vehicle is worth more than you owe on your auto loan.

Sales promotions increase the awareness of products, help introduce new products, and often create interest in the organizations that run the promotions. Coupons, contests, samples, and premiums are among the types of sales promotions aimed at consumers. Trade promotions, or promotions aimed at businesses, include trade shows, sales contests, trade allowances, and push money.

Trade-in Allowance

Of course, some dealers will try to undercut you – so do your research and familiarize yourself with the process, and you’re sure to get the most money possible for you car. If you own your car outright, the dealership will apply your trade-in amount to your new vehicle. For example, if you purchase a car for $25,000 and the dealership gives you $6,000 for your trade-in, you only need a loan for $19,000. And because the dealer knocked several thousand dollars off the final price of your automobile, you pay less in sales tax. Retail value represents the amount of money for which the dealer can expect to sell your trade-in vehicle to another party.