This results in the elimination of the accounts payable liability with a debit to that account, as well as a credit to the cash (asset) account, which decreases the balance in that account. A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company’s balance sheet. In fundamental accounting, debits are balanced by credits, which operate in the exact opposite direction.

Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. Accountants record increases in asset, expense, and owner’s drawing accounts on the debit side, and they record increases in liability, revenue, and owner’s capital accounts on the credit side.

Liability, revenue, and owner’s capital accounts normally have credit balances. To determine the correct entry, identify the accounts affected by a transaction, which category each account falls into, and whether the transaction increases or decreases the account’s balance.

Let’s illustrate the general journal entries for the two transactions that were shown in the T-accounts above. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting.

Is T account same as general ledger?

T-accounts are important because they let an accountant: Analyze the financial transactions by categorizes of accounts rather than by date. Visualize what is happening, which is useful when doing adjusting entries.

The general ledger is usually printed and stored in an organization’s year-end book, which serves as the annual archive of its business transactions. Jane wants to buy a $5,000 hot tub but doesn’t have the money at the time of the sale. The hot tub company would invoice her and allow her 30 days to pay off her debt. During that time, the company would record $5,000 in their accounts receivable.

How to Use Excel as a General Accounting Ledger

In a T-account, their balances will be on the right side. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased. This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded.

This the system in which you record an account receivable. Anyone analyzing the results of a business should compare the ending accounts receivable balance to revenue, and plot this ratio on a trend line. If the ratio is declining over time, it means that the company is having increasing difficulty collecting cash from its customers, which could lead to financial problems. When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash.

Why are T account used in accounting?

A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. The title of the account is then entered just above the top horizontal line, while underneath debits are listed on the left and credits are recorded on the right, separated by the vertical line of the letter T.

The credits and debits are recorded in ageneral ledger, where all account balances must match. The visual appearance of the ledger journal of individual accounts resembles a T-shape, hence why a ledger account is also called a T-account. The general ledger is comprised of all the individual accounts needed to record the assets, liabilities, equity, revenue, expense, gain, and loss transactions of a business. In most cases, detailed transactions are recorded directly in these general ledger accounts. In the latter case, a person researching an issue in the financial statements must refer back to the subsidiary ledger to find information about the original transaction.

When Jane pays it off, the money would go back to the sales amounts or cash flow. The amount of money owed to a business from their customer for a good or services provided is accounts receivable. Accounts receivable is recorded on your balance sheet as a current asset, implying the account balance is due from the debtor in a year or less. Most companies allow for a portion of their sales to be on credit. Often, a business offers this credit to frequent or special customers who receive periodic invoices.

- Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets.

Expenses normally have debit balances that are increased with a debit entry. Since expenses are usually increasing, think “debit” when expenses are incurred. In a T-account, their balances will be on the left side. The bottom set of T accounts in the example show that, a few days later, the company pays the rent invoice.

Since the service was performed at the same time as the cash was received, the revenue account Service Revenues is credited, thus increasing its account balance. A T account is a way to organize and visually show double-entry accounting transactions in the general ledger account.

The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance. Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. A credit to a liability account increases its credit balance. Whenever cash is received, the asset account Cash is debited and another account will need to be credited.

How to Calculate Credit and Debit Balances in a General Ledger

An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. Therefore, asset, expense, and owner’s drawing accounts normally have debit balances.

You may find the following chart helpful as a reference. With the accrual accounting, you record a transaction whether cash has been received or not.

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

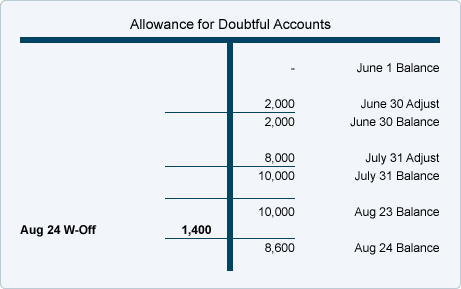

T- Account Recording

In practice, T accounts are not typically used for day-to-day transaction as most accountants will create journal entries in their accounting software. The T-account is also helpful in tracking track debits and credits to find accounting errors in journal entries. For different accounts, debits and credits may translate to increases or decreases, but the debit side must always lie to the left of the T outline and the credit entries must be recorded on the right side. The major components of thebalance sheet—assets, liabilitiesand shareholders’ equity (SE)—can be reflected in a T-account after any financial transaction occurs.

Understanding T-Account

Whenever an accounting transaction is created, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry being recorded against the other account. There is no upper limit to the number of accounts involved in a transaction – but the minimum is no less than two accounts.

Another way to visualize business transactions is to write a general journal entry. Each general journal entry lists the date, the account title(s) to be debited and the corresponding amount(s) followed by the account title(s) to be credited and the corresponding amount(s).