OBTP#B13696 ©2017 HRB Tax Group, Inc. The H&R Block Emerald Prepaid Mastercard® is a tax refund-related deposit product issued by Axos Bank®, Member FDIC, pursuant to a license by Mastercard International Incorporated. Emerald Financial Services, LLC is a registered agent of Axos Bank. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Not available at all locations and to all applicants.

Interest Income Accounting

Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. Available at participating U.S. locations. Valid for 2017 personal income tax return only.

All products subject to ID verification. If approved for an Emerald Advance℠, your credit limit could be between $350-$1000. Line of credit subject to credit and underwriting approval. Products offered only at participating offices. Promotional period 11/14/2019 – 1/10/2020.

A simple example of interest income and how it’s reported

Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return (federal or state).

Motley Fool Returns

Based on this statement the owner of the deposit gets a clear idea of how much taxable interest income he has earned on the financial assets. So the owner’s business gets the interest payment which is recorded in his income statement as income. If you aren’t the dependent of another taxpayer, you will have to file a tax return if your gross income is greater than or equal to the amount set each year by the IRS.

Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Each year, the bank is required to send you and the IRS a 1099-INT reporting how much interest was pay to the bank account.

A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited.

Loans are offered in amounts of $250, $500, $750, $1250 or $3,500. Approval and loan amount based on expected refund amount, ID verification, eligibility criteria, and underwriting.

- Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer.

- Available at participating U.S. locations.

- Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations.

Is interest income an asset?

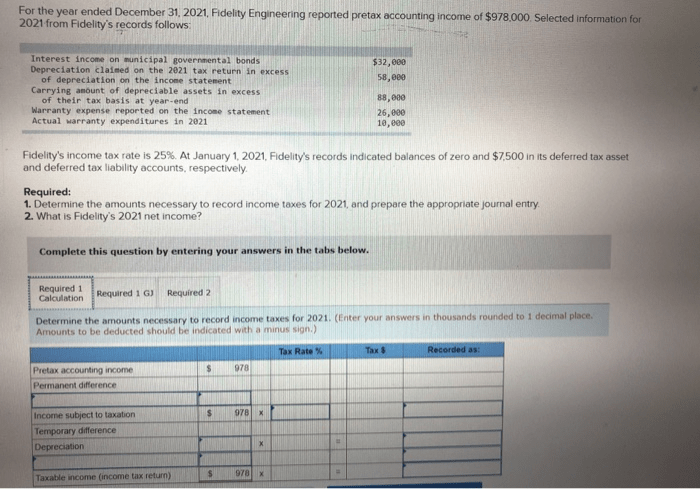

Definition: Interest income is the revenue earned by a lender for use of his funds or an investor on their investment over a period of time. This revenue is typically taxable and reported in the other income section of the income statement.

This statement outlines the amount of taxable interest income earned on the financial assets held at the bank and is used to prepare tax returns. When other taxpayers, such as your parents, are eligible to claim you as a dependent on their tax return, you still may need to file your own return. If the total of your unearned income is more than $1,100 for 2019, you need to file a return even if it is not required by your earned income. Unearned income covers all other earnings, such as taxable interest, dividends, and capital gains that aren’t the result of performing services.

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; See Free In-person Audit Support for complete details.

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Available at participating locations. By law, all interest earned on a savings account is taxable, even if it is just a few dollars per year.

Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

Financial institutions are required to send you a form known as a 1099-INT for interest earned during the year if you have earned more than $10 in interest during the tax year. If you earned less than $10 in interest from any one account, you may not receive a 1099-INT, but you are still required to report the interest to the IRS and pay any taxes due on it. The bank is required to send out the details giving how much interest it has paid the owner of the deposit in the bank account.

This threshold amount is largely dependent upon the standard deduction for your filing status. Your total gross income for the year includes all earnings that aren’t exempt from income tax. If you plan to file a joint return with your spouse, you must include the income you both earned. The Send A Friend coupon must be presented prior to the completion of initial tax office interview.

These accounting terms can tell us how much interest a company earned and how much it expects to earn in the future.

Emerald Advance℠ line of credit is a tax refund-related credit product. Emerald Card® is a tax refund-related deposit product. OBTP#B13696 ©2019 HRB Tax Group, Inc. This is an optional tax refund-related loan from Axos Bank®, Member FDIC; it is not your tax refund.