The board may discipline certificate and license holders, prescribe rules and regulations, investigate complaints, and, in general, regulate the practice of accounting in the state. Mission Statement The mission of the Nevada State Board of Accountancy is to protect the welfare of the citizens of the State of Nevada by assuring the competency of persons licensed as Certified Public Accountants (CPAs) and compliance with professional standards by registered CPA firms.

Rule 102 of the Accountancy Rules also provides that a Notice to Schedule (“NTS”) for the CPA examination is valid for six months after it is issued. Pursuant to the Proclamation, the Board Staff shall be entitled, in its discretion, to extend any unexpired NTS in effect during the pendency of the Emergency Orders by days per exam section.

The AICPA and NASBA also coordinate and maintain mutual recognition agreements with foreign accountancy institutes. The only countries with such agreements includeAustralia, Canada, Hong Kong, Ireland, Mexico, Scotland, and New Zealand. Accountants from these countries who meet the specified criteria may be able to sit for the International Qualification Examination (IQEX) as an alternative to the Uniform CPA Exam.

California Board of Accountancy

Under state law, any license not renewed by September 1 automatically expires and the holder of the expired license shall be prohibited from practicing public accounting or holding out as a certified public accountant or firm. To retain a license an individual must use the reinstatement process.

Candidates seeking additional extensions related to COVID-19 shall apply to the Board for a variance. The Board of Accountancy is the state agency responsible for licensing and regulating certified public accountants and certified public accounting firms. The Board is funded solely through fees charged to obtain and renew a license to practice public accounting and to sit for the CPA exam. The Board of Accountancy regulates Certified Public Accountants, Public Accountants, and Accounting Practitioners. The board examines applicants and issues certificates and licenses to certified public accountants and accounting practitioners.

Applicants requesting an extension should contact the Board Staff. The Board of Public Accountancy ensures accountants follow Massachusetts requirements, rules, and regulations. Our goal is to provide guidance to our licensees and protection to consumers.

Commonwealth of the Northern Mariana Islands

The rule revision has eliminated the requirement for candidates to take at least 15 of their 30 semester credit hours of upper division accounting courses from classes held in-person. The Board made the decision to adopt this emergency rule revision because many universities are moving classes online amid COVID-19 (Coronavirus) concerns. In the United States, the designation of Certified Public Accountant (CPA) is granted at state level. Individual CPAs are not required to belong to the American Institute of Certified Public Accountants (AICPA), although many do.

Licensed Certified Public Accountants (CPAs) are the only individuals or firms who can issue independent reports on financial statements of business entities or other organizations in Massachusetts. Licensees also provide management advisory and consulting services, prepare tax returns, provide advice on tax matters and other accounting services. Rule 402.01.b of the Idaho Accountancy Rules provides that a penalty of no more than fifty percent (50%) of the hours a licensee is short in meeting the calendar year CPE requirement may be assessed for (“CPE”) extensions. Pursuant to the proclamation, the Board Staff shall be entitled, in its discretion, to waive the monetary fine for those licensees with current approved CPE extensions and allow submission until June 15, 2020.

The Board also adopts and enforces the Rules of Professional Ethics and Conduct to be observed by CPAs in this State. The Missouri State Board of Accountancy is a unit of the Division of Professional Registration of the Department of Commerce and Insurance (DCI).

Pursuant to the Proclamation, the Board Staff shall be entitled, in its discretion, to extend the period and credit validity in 90-day increments for candidates affected by the COVID-19 pandemic and the exam site closures in effect as a result of the Emergency Orders. State boards of accountancy are responsible for assessing eligibility of candidates to sit for the CPA examination. Boards are also the final authority on communicating exam results received from NASBA to candidates.

The AICPA is responsible for setting and scoring the examination, and transmitting scores to NASBA. NASBA acts primarily as a forum for the state boards themselves, as opposed to AICPA which represents CPAs as individuals. SC LLR can assist you with examination information and materials, continuing education requirements and opportunities, licensure applications and renewals, board information, and more.

- The Board also adopts and enforces the Rules of Professional Ethics and Conduct to be observed by CPAs in this State.

- The Missouri State Board of Accountancy was created in 1909 by Senate Bill 112 and passed by the 44th General Assembly.

IQEX is also jointly administered by the AICPA and NASBA; however, state boards are not involved at the examination stage (only at licensure). Rule 102 of the Idaho Accountancy Rules (“Accountancy Rules”) provides the Application To Test (“ATT”) will expire 90 days after it is issued unless the candidate pays the applicable fees.

An agenda and conference call information will be posted on this website by Tuesday, April 21st. We invite any and all interested parties to participate in board meetings. Pursuant to the Proclamation, the Board Staff shall be entitled, in its discretion, to extend the thirty-six month window by six months for applicants affected by the COVID-19 pandemic and Emergency Orders. The Texas State Board of Public Accountancy adopted an emergency rule revision to Rule 511.57 Qualified Accounting Courses.

The Missouri State Board of Accountancy was created in 1909 by Senate Bill 112 and passed by the 44th General Assembly. The Board is a state agency and the members are appointed by the Governor and confirmed by the Senate. The Board is a cash funded agency, supported entirely by CPA candidates’ and licensees’ fees. The Public Accountancy Act is the set of statutes that govern the ability of the Board to regulate certified public accountants in Missouri.

In response to the Coronavirus pandemic, Governor Brad Little, declared a state of emergency in the State of Idaho through a proclamation on March 13, 2020. On March 18, 2020 Governor Little amended the proclamation relating to the Idaho Open Meetings Act, Chapter 2, Title 74, Idaho Code. This Act sets out important requirements to ensure that public business is not conducted in secret. Those requirements remain important during this time of emergency. The Idaho State Board of Accountancy will be conducting its next meeting on Tuesday, April 28th via teleconference.

Alaska Board of Public Accountancy

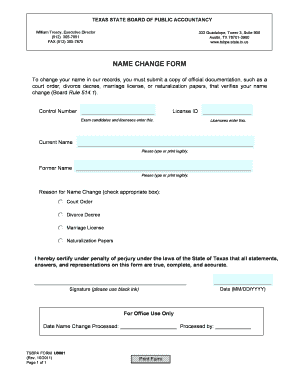

CPA lookup tool populated by official state regulatory data sent from Boards of Accountancy to a central database. The website represents a single-source national database of licensed CPAs and CPA firms. The offices of the Texas State Board of Public Accountancy are open and operational, and we will continue to perform the essential functions of our agency while providing the highest level of service possible.

Kenneth W. Boyd is a former Certified Public Accountant (CPA) and the author of several popular accounting books including ‘CPA Exam for Dummies’ and ‘Cost Accounting for Dummies’. Kenneth W. Boyd is a former Certified Public Accountant (CPA) and the author of several of the popular “For Dummies” books published by John Wiley & Sons including ‘CPA Exam for Dummies’ and ‘Cost Accounting for Dummies’. There are several reasons why you will need to contact your state board of accountancy for the CPA exam. Effective January 1, 2018, there will be only one version of the state-specific ethics course (SSE) course approved by the Tennessee State Board of Accountancy (Board) available for licensees to complete to meet the SSE requirement for renewal.

If an extension is approved, required documentation must be submitted no later than June 15, 2020. CPAs, like other licensed professions, are licensed by state government. The Louisiana legislature, similar to legislatures in all other states, has established a state board of accountancy to license and regulate CPAs in the public interest. NASBA, AICPA, Prometric and the Boards of Accountancy (Boards) continue to monitor the COVID-19 crisis and have taken the following actions. To protect the welfare of the citizens of the State of Nebraska by assuring the competency of persons licensed as Certified Public Accountants (CPAs).

At the April 28, 2020 Board meeting the Board discussed aspects of the CPA exam process, CPE, and licensure that may be impacted by the current COVID-19 pandemic and addressed those issues through a Proclamation. The Kansas Board of Accountancy’s (KSBOA) web site is a free service intended to provide useful information regarding CPAs and the practice of public accountancy in the State of Kansas. While the Board strives to provide accurate and reliable information, the Board does not warrant the accuracy of every item of information provided online and accepts no liability for damages of any kind resulting from reliance on this information.

CPAs using NASBA’s CPE Audit Service to track and store CPE records may generate a CPE summary from that site to attach to the license renewal. Licenses issued in 2019 have no CPE requirement for the 2019 renewal. Those new licensees should attach a statement or other document affirming their CPE exemption with the renewal application.

Rule 105 of the Accountancy Rules requires candidates to pass all four test sections of the CPA Examination with a grade of seventy-five or higher within an 18-month period, which begins on the date that the first test section is passed. The rule further provides that candidates who do not pass all four sections of the CPA Examination within the 18-month period lose credit for any test section(s) passed outside the 18-month period and that test section(s) is to be retaken.

Georgia State Board of Accountancy

The Board has partnered with the Tennessee Society of CPAs (TSCPAs) to help ensure that the most current and accurate state-specific content is included in the course material. Renewing CPAs may use the Board’s fillable reporting form or attach a list of their choosing (accepted formats include txt, gif, jpeg, jpg, png, doc, docx, rtf and pdf).