The disclosures will continue to show an analysis by time, purpose and perpetual restrictions. Which of the following is not true regarding accounting and financial reporting for nongovernmental, not-for-profit organizations? A) Expenses are classified as unrestricted or temporarily restricted.

Which of the following statements is not correct with respect to contributions to a private not-for-profit? A) Contributions to a not-for-profit are recorded at fair market value at the date of receipt.

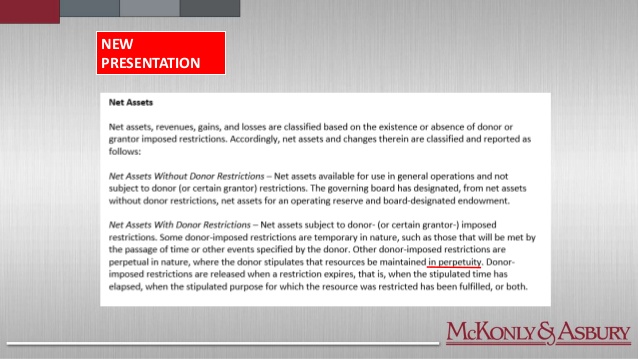

A NFP must present total net assets with donor restrictions, total net assets without donor restrictions and total net assets in the statement of financial position. Footnote disclosures are required to include the timing and nature of restrictions, as well as the composition of net assets with donor restrictions at the end of the period.

Permanently restricted net assets are assets held by a nonprofit entity for which donors have imposed usage restrictions that do not expire. Permanent restrictions are most commonly found when donors contribute large sums to nonprofits, and so are more inclined to control how the funds are used. Contributions restricted by donors to acquire long-lived assets are still required to be classified as donor-restricted support.

B) Expenses must be reported by function, either in the Statements of Activities or in the notes. C) Net assets are classified according to donor-imposed restrictions. Typically, restricted funds are not required to be placed into a segregated bank account, but they must be accounted for separately in a nonprofit’s financial statements.

Contributions to Acquire Long-Lived Assets

B) Contributions of assets other than cash to a not-for-profit are recorded at the donor’s basis. C) Contributions to a not-for-profit may be restricted as to purpose or time or for plant acquisition.

A clause often states this on the donation form and in the gift acknowledgment. Exceptions could be when donors are asked to give to a capital campaign, a building fund, or a scholarship fund. “Unrestricted” funds are donations the nonprofit may use for any purpose. Unrestricted funds usually go toward the operating expenses of the organization or to a particular project that the nonprofit picks.

Endowments that have a current fair value that is less than the original gift amount or amount required to be retained by the donor or law are known as underwater endowments. Disclosures will be required to include the original amount of the endowment, the NFP’s policy relating to the spending of these funds and whether or not the policy was followed. The accounting requirements for restricted funds can be managed in a few different ways, depending on the accounting software being used and the sophistication of the chart of accounts. The most effective practice is to display grants and contributions with donor restrictions in a separate column.

However, the release from restrictions are now classified to net assets without donor restrictions when the asset is acquired and placed into service, unless the donor placed a time restriction on the use of the asset. The option to release the contributions from restriction over the asset’s useful life has been eliminated by the standard. Which of the following financial statements is required for private not-for-profit organizations? Which of the following is not true of a Statement of Activities prepared for a private not-for-profit organization? A) Expenses are shown only as decreases in unrestricted net assets.

C) Statement of Financial Position, Statement of Net Assets, Statement of Functional Expenses. D) Statement of Financial Position, Statement of Activities, Statement of Cash Flows. If the nonprofit’s board of directors designates some of the nonprofit’s unrestricted assets for a specific purpose, those assets must continue to be reported as net assets without donor restrictions. Unrestricted net assets are donations to nonprofit organizations that can be used for any of the organization’s expenses or objectives.

Using this two-column approach works for both the income statement and the balance sheet. As shown in the income statement below, new income from a grant with donor restrictions is recorded and displayed in the With Donor Restrictions column.

B) Reclassifications for expiration of time restrictions are shown in the revenues and support section. C) Unrealized gains (losses) on investments are shown only as increases (decreases) in unrestricted net assets. D) Expenses are classified by function within the categories of Program Services and Supporting Services either in the Statement or the notes.

When budgeting, nonprofits should separate restricted and unrestricted funds so that they allocate the money they have to spend correctly. For example, if $100,000 is budgeted for restricted funds, it cannot be mistakenly spent for unrestricted purposes.

Temporarily restricted net assets

- In this example, FAN has recorded the three-year, $60,000 grant in the first year, as required.

- These funds are included in the total net assets on the balance sheet, but they are not actually available to the organization to use in any way except according to restriction.

Contributions can be time restricted, purpose restricted or both depending on the donor’s intentions. It is important that contributions received with restrictions are tracked properly and used according to the donor’s wishes. If funds are set aside internally, most often initiated by the Board, these funds would be Board designated net assets and are classified as net assets without donor restrictions. The key term in differentiating between the two net asset categories is donor. Most nonprofits ask for unrestricted funds when they solicit donors by email or direct mail.

If a donor restricts a nonprofit organization to allocate restricted funds to a specific purpose, it is required to do so by law. Failure to comply may result in the donor taking legal action and reporting the nonprofit to the Office of the Attorney General.

NFP Boardsoften earmark net assets for future programs, investments, contingencies, purchase/construction of fixed assets or other uses. To reduce confusion and enhance transparency, ASU reduces the number of classes of net assets from the above three to two – net assets without donor restrictions and net assets with donor restrictions.

What are the 3 types of net asset restrictions?

Permanently restricted and temporarily restricted net assets are combined into “net assets with donor restrictions.” This category includes amounts restricted by the donor in perpetuity, restricted for specified purposes, restricted by the passage of time and for amounts of underwater endowments.

Often associated with funds held by donations to nonprofit organizations or endowments, restricted funds ensure that donors alone can direct the usage of those assets. Let’s face it, not many people like change – especially when it comes to their daily routines and their jobs. Change can cause confusion and frustration.

Net Assets without Donor Restrictions

In this example, FAN has recorded the three-year, $60,000 grant in the first year, as required. After releasing the first $20,000, as shown on the income statement, the remaining balance of the grant award for years two and three is shown on the balance sheet as assets with donor restrictions. These funds are included in the total net assets on the balance sheet, but they are not actually available to the organization to use in any way except according to restriction. For this reason, it is strongly recommended to report restricted dollars separately, and to pay particular attention to the unrestricted amounts when planning and making operational decisions. In addition, directors and managers need adequate training to understand the nuances of restricted funds that present financial management challenges unique to nonprofit organizations.

Financial Reporting

First, restrictions are imposed by the donor when they make the gift or grant. Second, income must be recognized, or recorded in the accounting records, in the year that an unconditional commitment for the funds is received, regardless of when the related expenses will occur. These principles add a complexity to nonprofit financial reports due to the timing of funding, which makes accurate and reliable accounting especially important. The following examples – an income statement and balance sheet for the fictional nonprofit Family Advocacy Network (FAN) – illustrate how these rules work.

Nonprofit employees should be trained to identify expenditures that require allocation to restricted funds. When the staff correctly allocates money, it keeps donors satisfied and helps avoid legal disputes. When a donor gives money to a nonprofit organization, they may specify whether the gift is unrestricted and can be used for any purpose the organization sees fit. If the funds are temporarily restricted, they must be used for a specific purpose. With permanently restricted funds, the donation acts as principal on which interest can be earned (and only the interest is to be spent).

Once a contribution or grant is identified as restricted, the accounting and recordkeeping requirements are of paramount importance. Two principles are at the core of the accounting requirements.

I want to take a little time to discuss one of the changes that has affected nonprofit organizations recently. The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) , Presentation of Financial Statements of Not-for-Profit Entities on August 18, 2016. This new accounting standard is effective for fiscal years beginning after December 15, 2017. There are several financial reporting changes under this new accounting standard, but the one that I want to talk to you about and focus on is net asset classifications.

D) Revenues, including contributions are considered to be unrestricted unless donor-imposed restrictions apply. What are the financial statements required for all nongovernmental, not-for-profit organizations? A) Statement of Financial Position, Statement of Activities, Statement of Cash Flows, Statement of Functional Expenses. B) Statement of Financial Position, Statement of Activities, Statement of Functional Expenses.