Understanding Holding Costs

I still flip houses because I love flipping and it generates a lot of income. My market is also much easier to flip in right now because of the high prices. I can use private money, hard money, bank money, and partners to flip houses. Those lenders don’t mind short-term loans that are one or two years in length.

Even though I think long-term rentals provide a better investment over time, I still do many house flips to generate income. I actually use much of the income from my fix and flips to purchase long-term rental properties.

I have been flipping houses since 2014 and to date have completed 14 flips. Jason is a full-time house flipper that has been flipping houses for over 5 years and to date has completed 14 flips. He is also a real estate agent as well as a writer and editor for Flipping Prosperity.

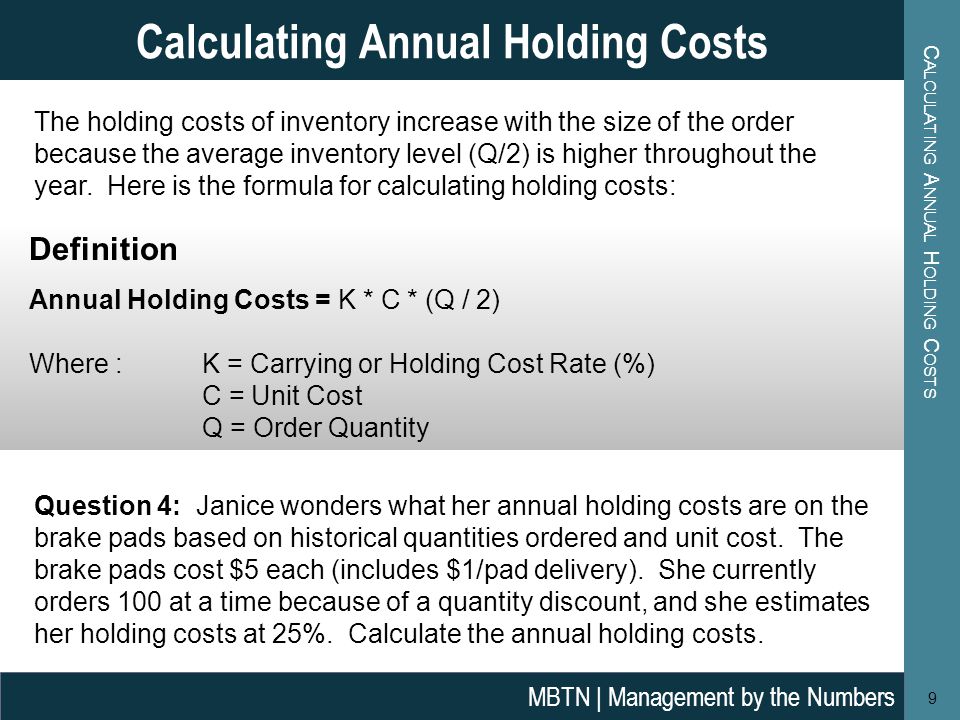

Annual usage may equal the prior year’s units sold, forecast-sales units or a combination of both. In turn, the order-placement cost includes order-processing costs, shipping and order-receipt costs and stocking costs. Such costs include the cost to create a purchase order, process the materials on receipt, process a vendor invoice and issue a payment. Carrying costs are the variable per-unit-holding costs, such as credit interest, inventory-insurance costs and storage costs. When large quantities are ordered or produced, inventory holding costs are increased, but ordering/setup costs decrease.

In a periodic inventory policy, the inventory level is checked periodically (such as once a month) and an order is placed at that time as to meet the expected demand until the next order. In this case, the safety stock is calculated considering the demand and supply variability risks during this period plus the replenishment lead time. In this case, safety stock is calculated considering the risk of only the replenishment lead time. If applied correctly, continuous inventory policies can lead to smaller safety stock whilst ensuring higher service levels, in line with lean processes and more efficient overall business management. However, continuous inventory policies are much harder to implement, so most of the organisations using traditional planning processes and tools opt for periodic inventory policy.

Learn How to Analyze a House Flip

With fix and flips, I want to make sure I can sell the house for a profit in less than 6 months and I am not worried about the location, cash flow or cash on cash return as much. You can depreciate the structure which means it is possible to lose money on paper, but make money in reality.

What is a holding cost in real estate?

Holding costs are those associated with storing inventory that remains unsold. These costs are one component of total inventory costs, along with ordering and shortage costs. A firm’s holding costs include the price of goods damaged or spoiled, as well as that of storage space, labor, and insurance.

Conversely, when lot sizes decrease, inventory holding/carrying costs decrease, but the cost of ordering/setup increases since more orders/setups are required to meet demand. When the two costs are equal (holding/carrying costs and ordering/setup costs) the total cost (the sum of the two costs) is minimized. Cycle inventories, sometimes called lot-size inventories, result from this process. Usually, excess material is ordered and, consequently, held in inventory in an effort to reach this minimization point. Hence, cycle inventory results from ordering in batches or lot sizes rather than ordering material strictly as needed.

The biggest reason I like long-term rental properties is the cash flow. Many properties will provide great cash flow, but not very much income if I were to flip the homes. Likewise, many fix and flips can provide great income if repaired and sold, but not much cash flow if rented. The area, bedroom count, cost of the home all must be taken into consideration on whether the house will be a better fix and flip or buy and hold rental. The EOQ model finds the economic order quantity by taking the square root of 2 multiplied by the number of units sold per year and the order-placement cost divided by a unit’s carrying cost per period.

The less accurate the forecast, the more safety stock is required to ensure a given level of service. With an MRP worksheet, a company can judge how much it must produce to meet its forecasted sales demand without relying on safety stock. However, a common strategy is to try to reduce the level of safety stock to help keep inventory costs low once the product demand becomes more predictable.

As a real estate agent, it is easy for me to determine the values on houses. Since the small towns are farther away and have less certainty in the rental market I do not buy rentals in them. Small towns are also the hardest hit when the market goes down or vacancies go up. I complete fix and flips a year and I also own 16 long-term rental properties. I have very strict guidelines that my rental properties must meet; cash flow, cash on cash return, location, condition, age and more.

I have kept flipping houses because the profit margins are still there on the flips. There are almost always opportunities to flip houses, but there are not always opportunities to make money with rentals. Although I stopped buying residential rentals in my market, I have been buying commercial properties in the last few years which do make money.

The amount of safety stock that an organization chooses to keep on hand can dramatically affect its business. In addition, products that are stored for too long a time can spoil, expire, or break during the warehousing process. Too little safety stock can result in lost sales and, in the thus a higher rate of customer turnover. As a result, finding the right balance between too much and too little safety stock is essential.

- There are almost always opportunities to flip houses, but there are not always opportunities to make money with rentals.

- I have kept flipping houses because the profit margins are still there on the flips.

- Although I stopped buying residential rentals in my market, I have been buying commercial properties in the last few years which do make money.

You can depreciate or deduct almost all of the expenses including the interest on the loan. When you sell a rental you also pay long-term capital gains taxes most of the time which is lower than short term capital gains (flips).

I can use these other sources to finance rentals, but at some point will need to refinance into a long-term loan. That would make you think a flip is harder to find than a good rental property but that is not the case for me. It is easier for me to find a good flip because I do not worry about the neighborhood, the age of the home, or other factors that concern me with a long-term hold property. I do not like old rentals because they will have more maintenance and cost me more money eventually. I do not worry as much about buying older flips because I will not be holding on to them.

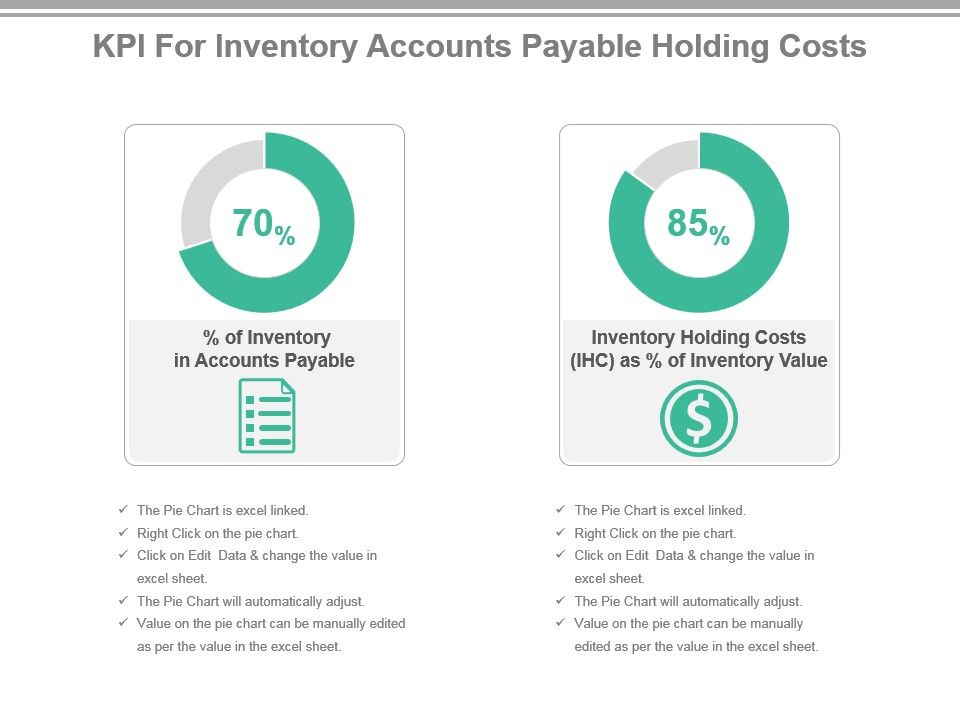

Carrying costs are usually 15% to 30% of the value of a company’s inventory. This is a significant figure as it tells the company how long they can keep their inventory before they start losing money over unsalable items. Additionally, it shows how much they need to sell and buy in order to maintain appropriate inventory levels.

How is holding cost calculated?

Holding Costs (also known as carrying costs) are the monthly holding costs that you will incur while you are holding the property, such as property taxes, insurance, utilities and maintenance costs.

What Are Examples of Cost of Goods Sold (COGS) for Businesses That Sell Online?

I think you can flip houses in just about any market although you will need more money to flip when housing prices are high. It is harder to find great rentals in every market because rents tend not to keep up with home prices when values are high. This article goes over the pros and cons of buying and holding rental properties as well as house flips.

I complete 20 to 30 fix and flips every year, and I also own 20 long-term rental properties. I have certain guidelines I use to determine if I will flip a house, or hold it as a rental property. There are many factors I take into account, but I have much stricter criteria for my rentals than I do my house flips. Hi, my name is Jason and I am a full-time house flipper and real estate agent.

Calculating carrying cost and knowing how to minimize it can help a company reclaim money tied up in inventory and increase its profits. If a house needs a lot of work; new kitchen, new baths, carpet, paint, roof it can cost $20,000 to $30,000 or more to repair the home. I am already putting 20% down on my rental properties and adding $30,000 in repairs on top of the down payment means I may have $50,000 or more into a rental property. Having that much cash into a rental will lower my cash on cash returns and limit my ability to buy more rental properties.

MARKET RESEARCH

I can refinance my rentals, but I usually have to wait a year to take cash out. It is easier for me to find a property to fix and flip because I have such strict buying criteria on my rentals.

It may seem like a long time to get your money back out of a rental, but it can take just as long to get money out of a flip. My average time to flip a house is about 6 months, but the big projects can take much longer. Flipping houses is not an amazing advantage over rentals because of the time it takes to flip and the costs to flip. If I had to choose between buying more flips and buying more rentals, I would buy more rentals. I love the long-term cash flow, and if you refinance them you don’t have to have that much cash tied up in the property.

In marketing, carrying cost, carrying cost of inventory or holding cost refers to the total cost of holding inventory. This includes warehousing costs such as rent, utilities and salaries, financial costs such as opportunity cost, and inventory costs related to perishability, shrinkage (leakage) and insurance. When there are no transaction costs for shipment, carrying costs are minimized when no excess inventory is held at all, as in a Just In Time production system. The size of the safety stock depends on the type of inventory policy in effect. An inventory node is supplied from a “source” which fulfills orders for the considered product after a certain replenishment lead time.

I buy my rental properties based on cash flow and I assume I will hold them for many years, if not forever. I want to make sure my rentals are great properties that will be easy to manage. I am very picky about the location, condition, and age because I am holding these properties so long. Even though I think it makes more sense to buy and hold properties for long-term wealth, I still fix and flip homes. There are some homes that work great as fix and flips, and some homes that work better as rentals.