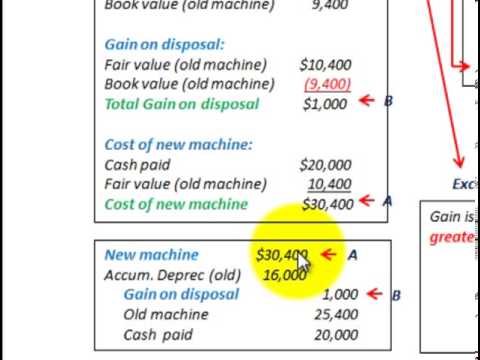

So, as you can see, you must take into account how much of the cost of the asset you have already written off to determine any subsequent gain or loss. The income statement is one of your company’s basic financial documents. Investors, lenders and customers, among others, may use the income statement — along with your balance sheets and cash-flow statement — to judge the health of your business.

The company believes this change could impair some of its long-lived assets. The company groups assets at the lowest level with identifiable cash flows and tests them for impairment. One group is the ScioTech operation, which is not a reporting entity.

Since depreciation of an asset can be used to deduct ordinary income, any gain from the disposal of the asset must be reported and taxed as ordinary income, rather than the more favorable capital gains tax rate. When you dispose of a capital asset, the amount of depreciation allowable for that asset will be taxed at your ordinary income rates, not the capital gains rate. This means that if you realize a capital gain on the sale or other disposition of property used in your trade or business, you probably won’t get the benefit of the special capital gains tax rate on theentireamount of your gain. Gain or loss on the sale or exchange of amortizable or depreciable intangible property held longer than 1 year (other than an amount recaptured as ordinary income) is a section 1231 gain or loss.

Depreciation recapture is the gain realized by the sale of depreciable capital property that must be reported as ordinary income for tax purposes. Depreciation recapture is assessed when the sale price of an asset exceeds the tax basis or adjusted cost basis.

There is no depreciation to recapture if a loss was realized on the sale of a depreciated asset. When you sell, scrap, or otherwise remove a capital asset from your business, you’ll have to report the change to the IRS. The good news is that long-term capital gains are taxed at a lower rate than other income, and if you have a loss on the property, you can deduct it. The bad news is that you may have ordinary income as a result of expensing or depreciation. And, you may find yourself subject to the 3.8 percent tax on Net Investment Income.

If you elected to depreciate the item instead of taking the Sec. 179 expense election, your depreciation deduction would be $200, and your adjusted basis after the first year would be $800 ($1,000 – $200). If you then sold the equipment for $900, you would have a $100 ($900 – $800) taxable gain. Because you recovered $100 of your cost as the depreciation you had previously taken as a deduction. On the other hand, if you had sold it for $500, you would have a $300 deductible loss.

The income statement reports your revenues, then subtracts various factors such as cost of goods sold, operating expenses, depreciation and taxes to determine whether your net income was positive or negative for the accounting period. If you sell off an asset for more than its worth, you report it as revenue on your income statement. In a period when an entity disposes of a component, the income statement of a business or the statement of activities of an NPO must report the results of the component’s operations as discontinued operations. The entity would recognize the gain or loss from classifying the component as held for sale or disposal in discontinued operations. If the disposal group is a component of an entity, as in the earlier ABC example, the component’s operations results (a $400,000 loss) are included in discontinued operations for year 1.

The tax consequences depend upon how the property was used, how long it was owned and the method of disposition. There are numerous ways of disposing of an asset, such as selling, scrapping, converting to personal use, contributing to a charity, exchanging for another like business item, or even giving it away. Adjusted basis is generally the cost of the item reduced by any business deductions taken for the item. For example, you purchase computer equipment for $1,000 and it is in a class of business property that must be depreciated over 5 years. You can elect to write-off any portion of the item the first year (within the Sec. 179 expense limitations) and depreciate the balance over five years.

ABC will report the results of discontinued operations in its year 1 income statement, as shown in exhibit 4. Asset D, the primary asset, has a remaining life of eight years. This determines the period over which the company will estimate cash flows to see if the carrying amount is recoverable. Assume future cash flows for the next eight years are $1,700,000 with an additional $75,000 realized from disposing of the group at the end of the period. In exhibit 2 the $750,000 impairment loss is allocated pro rata to assets A, B, C, D and E.

The treatment of section 1231 gain or loss and the recapture of amortization and depreciation as ordinary income are explained in chapter 3. 535, Business Expenses, for information on amortizable intangible property and chapter 1 of Pub. 946, How To Depreciate Property, for information on intangible property that can and cannot be depreciated. Gain or loss on dispositions of other intangible property is ordinary or capital depending on whether the property is a capital asset or a noncapital asset. Many taxpayers fail to understand the tax ramifications of disposing of personal property such as equipment, furniture and autos used in business and end up with unpleasant surprises at tax time.

EXECUTIVE SUMMARY TO ESTABLISH A SINGLE MODEL BUSINESSES CAN follow, FASB issued Statement no. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. FASB intends it to resolve implementation issues that arose from its predecessor, Statement no. 121, Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of. IMPAIRMENT EXISTS WHEN THE CARRYING AMOUNT of a long-lived asset or asset group exceeds its fair value and is nonrecoverable. CPAs should test for impairment when certain changes occur, including a significant decrease in the market price of a long-lived asset, a change in how the company uses an asset or changes in the business climate that could affect the asset’s value. Depreciation recapture is a tax provision that allows the IRS to collect taxes on any profitable sale of an asset that the taxpayer had used to previously offset his or her taxable income.

Recapture Rules that Apply to Dispositions of Section 197 Intangibles after August 8, 2005

- Gains and losses from the sale of business assets are not included on the business schedule in the tax return where net profit or loss from operating the business is figured, and generally do not affect the taxpayer’s self-employment tax.

- Gains to the extent they are attributable to depreciation are generally treated as ordinary income (but still not taxable for self-employment tax purposes), and any additional gain is treated as capital gain.

The company needs to increase B’s fair value by $27,500 to $160,000 and allocate an additional $27,500 loss pro rata to assets A, C, D and E. CPAs should review depreciation estimates and methods for the assets according to the requirements of APB Opinion no. 20, Accounting Changes. There is a significant adverse change in the business climate in one of the industries North Bay Inc. operates in.

Current conditions have reduced the fair value of inventory, which has a carrying value of $175,000. Using applicable GAAP (lower of cost or market rule), North Bay determines the inventory’s fair value is $150,000. It must make inventory adjustments before testing for long-lived asset impairment. It adjusts inventory down by $25,000 and reports this amount in the income statement. When a company recognizes an impairment loss for an asset group, it must allocate the loss to the long-lived assets in the group on a pro rata basis using their relative carrying amounts.

How to record the disposal of assets

The difference between these figures is thus “recaptured” by reporting it as ordinary income. Instead, assume the equipment in the example above was sold for $12,000. In that case, the entire accumulated depreciation of $8,000 is treated as ordinary income for depreciation recapture purposes. The additional $2,000 is treated as a capital gain, and it is taxed at the favorable capital gains rate.

loss on sale of assets definition

Gains and losses from the sale of business assets are not included on the business schedule in the tax return where net profit or loss from operating the business is figured, and generally do not affect the taxpayer’s self-employment tax. Generally, losses from selling business assets are fully deductible in the year of sale. Gains to the extent they are attributable to depreciation are generally treated as ordinary income (but still not taxable for self-employment tax purposes), and any additional gain is treated as capital gain.

Asset Disposal

There is an exception when the loss allocated to an individual asset reduces its carrying amount below fair value. If CPAs can determine fair value without undue cost and effort, the asset should be carried at this amount.

This requires an additional allocation of the impairment loss (explained below). The adjusted carrying value after the allocation becomes the new cost basis for depreciation (amortization) over the asset’s remaining useful life.

The $220,000 loss on the disposal group is part of discontinued operations in year 1. The year 2 income statement will include—as discontinued operations—the component’s operations for January through disposal in May, with the $15,000 gain on disposal also reported here. Discontinued operations less applicable taxes or benefits must be reported as a separate component of income before extraordinary items and the cumulative effect of accounting changes.

If the asset was held for over a year, the long-term capital gains rates will apply. Companies must adjust the carrying amounts of assets (including goodwill) that are part of a disposal group classified as held for sale not covered by Statement no. 144 in accordance with other applicable GAAP before measuring the group’s fair value. A long-lived asset held for sale must be measured at the lower of its carrying amount or fair value less cost to sell—the incremental direct costs the company would not have incurred if not for the decision to sell. Examples of such costs include broker commissions, legal and title transfer fees and closing costs necessary to transfer title. Assets classified as held for sale are not depreciated or amortized.

As an example of a gain or loss calculation, ABC Company has a machine that originally cost $80,000 and against which $65,000 of accumulated depreciation has been recorded, resulting in a carrying amount of $15,000. The entry to record the transaction is a debit of $65,000 to the accumulated depreciation account, a debit of $18,000 to the cash account, a credit of $80,000 to the fixed asset account, and a credit of $3,000 to the gain on sale of assets account. The net effect of this entry is to eliminate the machine from the accounting records, while recording a gain and the receipt of cash. The impairment loss allocated to a long-lived asset should not reduce its carrying value below fair value. Assuming asset B’s fair value is $160,000, the pro rata allocation reduces its carrying value below fair value (carrying value is $132,500—$27,500 below fair value).