The International Financial Reporting Standards(IFRS) is the most common set of principles outside the United States and is used in places such as the European Union, Australia, Canada, Japan, India, and Singapore. To reduce tension between these two major systems, the FASB and International Accounting Standards Board are working to converge standards. Accrual accounting is based on the matching principle, which is intended to match the timing of revenue and expense recognition. By matching revenues with expenses, the accrual method is intended to give a more accurate picture of a company’s true financial condition. Under the accrual method transactions are recorded when they are incurred rather than awaiting payment.

just simple question .wat are the three golden rules of accounts?

The International Accounting Standards Board (IASB) issues International Financial Reporting Standards (IFRS). These standards are used in over 120 countries, including those in the European Union (EU). However, the FASB and the IASB continue to work together to issue similar regulations on certain topics as accounting issues arise. For example, in 2016 the FASB and the IASB jointly announced new revenue recognition standards.

Today, the Financial Accounting Standards Board (FASB), an independent authority, continually monitors and updates GAAP. Generally accepted accounting principles, or GAAP, are a set of rules that encompass the details, complexities, and legalities of business and corporate accounting. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. In cash-basis accounting, companies record expenses in financial accounts when the cash is actually laid out, and they book revenue when they actually hold the cash in their hot little hands or, more likely, in a bank account. For example, if a painter completed a project on December 30, 2003, but doesn’t get paid for it until the owner inspects it on January 10, 2004, the painter reports those cash earnings on her 2004 tax report.

Under accrual accounting, the construction company would recognize a percentage of revenue and expenses corresponding to the portion of the project that was complete. How much actual cash coming into the company, however, would be evident on the cash flow statement. This method would show a prospective lender a much more complete picture of the company’s revenue pipeline. Cash accounting is an accounting method that is relatively simple and is commonly used by small businesses.

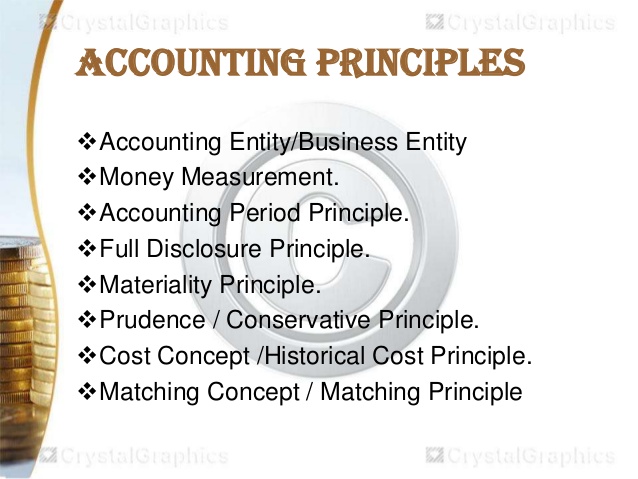

The Four Accounting Principles

Accounting method refers to the rules a company follows in reporting revenues and expenses. Cash accounting reports revenue and expenses as they are received and paid; accrual accounting reports them as they are earned and incurred.

IFRS is a set of international accounting standards, which state how particular types of transactions and other events should be reported in financial statements. GAAP is a common set of accepted accounting principles, standards, and procedures that companies and their accountants must follow when they compile their financial statements. The standards that govern financial reporting and accounting vary from country to country. In the United States, financial reporting practices are set forth by the Financial Accounting Standards Board (FASB) and organized within the framework of the generally accepted accounting principles (GAAP).

According to Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants (AIA). Federal endorsement of GAAP began with legislation like the Securities Act of 1933and the Securities Exchange Act of 1934, laws enforced by the U.S.

International Financial Reporting Standards (IFRS) are a set of international accounting standards, which state how particular types of transactions and other events should be reported in financial statements. IFRS are issued by the International Accounting Standards Board (IASB), and they specify exactly how accountants must maintain and report their accounts.

In response, the federal government, along with professional accounting groups, set out to create standards for the ethical and accurate reporting of financial information. With the advances in technology, this process has been automated and improved.

Internationally, the International Accounting Standards Board (IASB) issues International Financial Reporting Standards (IFRS). There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses.

Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions. You will also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company’s income statement reports a company’s profitability.

- International Financial Reporting Standards (IFRS) are a set of international accounting standards, which state how particular types of transactions and other events should be reported in financial statements.

- The value of accrual accounting becomes more evident for large, complex businesses.

Using this standard accounting methods helps investors and lenders get an accurate read on a business’s financial health if a company is looking to finance a new purchase or venture. The IRS requires that businesses use one accounting system and stick to it (see below for an exception).

Businesses of all sizes are now using financial management software to streamline accounting processes and reduce human error. The different types of accounting packages available today can accomplish a variety of tasks, from data entry to e-filing and reporting.

In cash-basis accounting, cash earnings include checks, credit-card receipts, or any other form of revenue from customers. Many countries around the world have adopted the International Financial Reporting Standards (IFRS). IFRS is designed to provide a global framework for how public companies prepare and disclose their financial statements.

What are the 5 basic accounting principles?

principal definition. In financial accounting this term refers to the amount of debt excluding interest. Payments on mortgage loans usually require monthly payments of principal and interest.

So the book of the company would look weak until the revenue actually came in. If this company was looking for financing from a bank, for example, the cash accounting method makes it look like a poor bet because it is incurring expenses but no revenue. GAAP is not the international accounting standard; this is a developing challenge as businesses become more globalized.

Whether they use the cash or accrual method determines when they report revenue and expenses. Management accounting is useful to all types of businesses and tax accounting is required by the IRS. On the recommendation of the American Institute of CPAs (AICPA), the FASB was formed as an independent board in 1973 to take over GAAP determinations and updates. The board is comprised of seven full-time, impartial members, ensuring it works for the public’s best interest. In addition, the board is monitored by the 30-person Financial Accounting Standards Advisory Council(FASAC).

Basic Accounting Principles and Guidelines

In this case, his bottom line is $1,200 less with no revenue to offset it, and his net profit (the amount of money the company earned, minus its expenses) for the business in 2004 is lower. This scenario may not necessarily be a bad thing if he’s trying to reduce his tax hit for 2004. International Accounting Standards are an older set of standards that were replaced by International Financial Reporting Standards (IFRS) in 2001.

This means a purchase order is recorded as revenue even though fund are not received immediately. The same goes for expenses in that they are recorded even though no payment has been made. Beyond the 10 principles, GAAP compliance is built on three rules that eliminate misleading accounting and financial reporting practices. These rules create consistent accounting and reporting standards, which provide prospective and existing investors with reliable methods of evaluating an organization’s financial standing. Without these rules, accountants could use misleading methods to paint a deceptive picture of a company or organization’s financial standing.

In cash accounting, transaction are only recorded when cash is spent or received. In cash accounting, a sale is recorded when the payment is received and an expense is recorded only when a bill is paid. The cash accounting method is, of course, the method most of us use in managing personal finances and it is appropriate for businesses up to a certain size. If a business generates more than $5 million in annual sales, however, it must use the accrual method, according to Internal Revenue Service rules. Financial accounting is performed with potential lenders and investors in mind, as well as GAAP (generally accepted accounting principles).

The value of accrual accounting becomes more evident for large, complex businesses. A construction company, for example, may undertake a long-term project and may not receive complete cash payments until the project is complete. Under cash accounting rules, the company would incur many expenses but would not recognize revenue until cash was received from the customer.

MANAGE YOUR BUSINESS

Adopting a single set of world-wide standards simplifies accounting procedures for international countries and provides investors and auditors with a cohesive view of finances. IFRS provides general guidance for the preparation of financial statements, rather than rules for industry-specific reporting. Accrual accounting concept has required the revenues and expenses to be recorded and recognized in the entity’s financial statements when they are incurred rather than when cash is paid or received. Generally accepted accounting principles refer to a common set of accepted accounting principles, standards, and procedures that companies and their accountants must follow when they compile their financial statements.

FASB is responsible for the Accounting Standards Codification, a centralized resource where accountants can find all current GAAP. Without regulatory standards, companies would be free to present financial information in whichever format best suits their needs. With carte blanche to portray a company’s fiscal standing in the most ideal light, investors could be easily misled. The Great Depression in 1929, a financial catastrophe which caused years of hardship for millions of Americans, was primarily attributed to faulty and manipulative reporting practices among businesses.

They can be integrated with other IT systems, such as CRM software or e-commerce platforms, for enhanced functionality. Some support complex operations like electronic payments, stock control and value-added tax schemes. If he uses the cash-basis accounting method, because no cash changes hands, the carpenter doesn’t have to report any revenues from this transaction in 2004.