A capital lease is a contract entitling a renter to the temporary use of an asset, and such a lease has the economic characteristics of asset ownership for accounting purposes. The capital lease requires a renter to book assets and liabilities associated with the lease if the rental contract meets specific requirements. In essence, a capital lease is considered a purchase of an asset, while an operating lease is handled as a true lease under generally accepted accounting principles (GAAP). The capitalized lease method is an accounting approach that posts a company’s lease obligation as an asset on the balance sheet. An operating lease for equipment or property does not count as an asset for a company.

It guarantees the lessee, also known as the tenant, use of an asset and guarantees the lessor, the property owner or landlord, regular payments for a specified period in exchange. Both the lessee and the lessor face consequences if they fail to uphold the terms of the contract. The difference between a capital lease vs operating lease – A capital lease (or finance lease) is treated like an asset on a company’s balance sheet, while an operating lease is an expense that remains off balance sheet. Think of a capital lease as more like owning a property and think of an operating lease as more like renting a property. Operating leases are counted as off-balance sheet financing—meaning that a leased asset and associated liabilities of future rent payments are not included on a company’s balance sheet, to keep theratio of debt to equitylow.

What is operating lease with example?

An operating lease is an agreement to use and operate an asset without ownership. Common assets. Examples include property, plant, and equipment. Tangible assets are seen and felt and can be destroyed by fire, natural disaster, or an accident.

Second, the lease must contain a bargain purchase option for a price less than the market value of an asset. Third, the lessee must gain ownership at the end of the lease period. Finally, the present value of lease payments must be greater than 90% of the asset’s market value.

The changes impact balance sheets with potentially large changes in both assets and liabilities. Operating leases, however, where an asset was viewed as simply being “rented”, and ownership was not transferred, were not included in the balance sheet as an asset or liability. Data on these leases was “off the books”, but included in notes to the financial statements. Often analysts would scour the notes, and “capitalize” the operating leases, in order to include them in companies’ long-term liabilities as debt. There’s been a big change that’s been occurring in the financial world as it pertains to accounting for leases, and it is and will have a major impact on company balance sheets.

When a lease is capitalized, the lessee creates an asset account for the leased item, and the asset value on the balance sheet is the lesser of the fair market value or the present value of the lease payments. The lessee also posts a lease obligation in the liability section of the balance sheet for the same dollar amount as the asset. Over time, the leased asset is depreciated and the book value declines.

What is meant by operating lease?

Definition: An operating lease is a short-term lease or contract in which the lessee agrees to rent an asset from the lessor and the lessor retains the rights of ownership. In other words, an operating lease is a lease that is less than one year in length and the lessor always maintains ownership of the leased asset.

Capital Expenditures vs. Operating Expenditures: What’s the Difference?

Historically, operating leases have enabled American firms to keep billions of dollars of assets and liabilities from being recorded on their balance sheets, thereby keeping their debt-to-equity ratios low. A capital lease is an example of accrual accounting’s inclusion of economic events, which requires a company to calculate the present value of an obligation on its financial statements.

That means the lease payments are treated as operating expenses and the asset does not show on the balance sheet.A financial lease is generally treated like loan. Here, asset ownership is considered by the lessee, so the asset appears on the balance sheet. Leases are legal and binding contracts that set forth the terms of rental agreements in real estate and real and personal property. These contracts stipulate the duties of each party to effect and maintain the agreement and are enforceable by each. A lease is a contract outlining the terms under which one party agrees to rent property owned by another party.

However, unlike an out-and-out purchase transaction in that the lessee doesn’t present the obligated balance as debt, shows payments as expensed, and retains the equipment title. During the lease period, the finance company is considered as the legal owner of the asset.

The Financial Accounting Standards Board has set criteria for treating an operating lease as a capital lease. Depending on the company’s requirement and tax situation, they may opt for one or the other, or possibly even a combination of both for different types of assets. Organisations often choose to lease long-term assets rather than buying them. The decision to lease is mainly based on certain factors like necessity, better financial terms, keep the assets off the balance sheet, or the lack of available funding.

- Even though a capital lease is a rental agreement, GAAP views it as a purchase of assets if certain criteria are met.

- However, recognizing leases on the balance sheet at adoption is one thing; remaining compliant going forward is another.

- Unlike operating leases that do not affect a company’s balance sheet, capital leases can have an impact on companies’ financial statements, influencing interest expense, depreciation expense, assets, and liabilities.

Those remeasurements will also require an entity to provide additional disclosures, such as noncash information about lease liabilities arising from ROU assets. A financial lease is similar to an out-and-out purchase transaction which has been financed through a term loan, in that the payments are made on a monthly basis.

The company shows lease payments as an expense, and does not claim ownership of the property that is leased. In some cases a fully-paid capital lease can transfer all of the property to the company.

The lessee simply records the monthly lease payment as a debit to lease or rent expense and a credit to cash. An operating lease is a contract that allows for the use of an asset but does not convey ownership rights of the asset. Operating leases are considered a form of off-balance-sheet financing—meaning a leased asset and associated liabilities (i.e. future rent payments) are not included on a company’s balance sheet.

While an operating lease expenses the lease payments immediately, a capitalized lease delays recognition of the expense. Entities, even private companies, will need to implement systems and processes to not only recognize new leases on the balance sheet, but also to capture changes requiring remeasurement of existing leases in a timely manner.

Historically, companies have listed capital leases – which cover situations where an asset is essentially treated as owned, as an asset and corresponding liability reported on the balance sheet. Typically the liability for capital leases would be viewed as long-term debt. In contrast, a capital lease involves the transfer of ownership rights of the asset to the lessee. The lease is considered a loan (debt financing), and interest payments are expensed on the income statement.

Because a lease is a contractual agreement, both parties are obligated to abide by it for its duration. Rent must be paid in a timely and consistent manner — usually at the 1st of the month — and often, late payments are penalized as per the lease’s terms. On the other hand, the property owner cannot unilaterally end the lease or change the conditions without the tenant’s (the rent payer’s) agreement.

What Are Typical Forms of Capital Assets Within a Manufacturing Company?

Operating lease and Finance lease are the two kinds of accounting methods for leases. Both kinds of leases are used for different purposes and results in differing treatment in accounting. When the lease is signed, no assets or liabilities are added to the books.

Businesses are not static, evolving over time to address their customers’ needs and changes in business environments and to remain competitive and operate efficiently. All these events will require accounting attention, and many public companies are currently spending significant time to comply with those requirements. If a private company does not address those events as they occur, it could become quickly challenging to catch up.

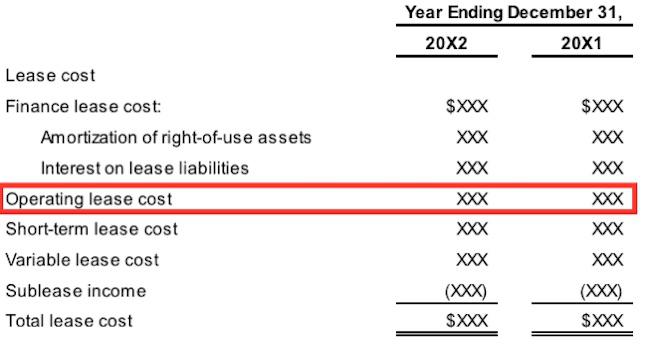

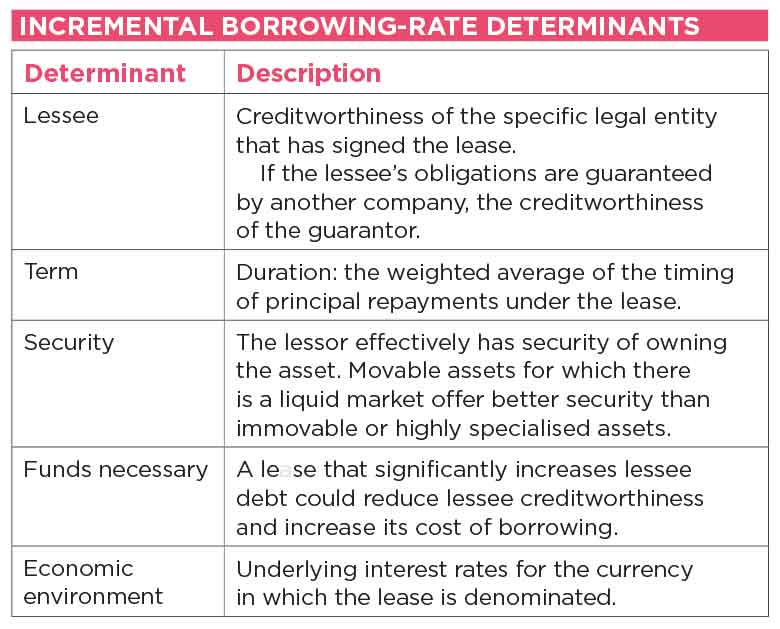

The present market value of the asset is included in the balance sheet under the assets side and depreciation is charged on the income statement. On the other side, the loan amount, which is the net present value of all future payments, is included under liabilities. In February 2016, FASB issued new lease accounting requirements in Accounting Standards Update (ASU) No. , Leases (Topic 842). Under its core principle, a lessee recognizes a right-of-use (ROU) asset and a lease liability on its balance sheet for most leases, including operating leases. This is expected to have a significant impact on most entities’ balance sheets, considering how prevalent and routine leasing is to most businesses.

Capitalizing an Operating Lease

To qualify as a capital lease, a lease contract must satisfy any of the four criteria. First, the life of the lease must be 75% or greater for the asset’s useful life.

Historically, operating leases have enabled American firms to keep billions of dollars of assets and liabilities from being recorded on their balance sheets. An operating lease is different in structure and accounting treatment from a capital lease. An operating lease is a contract that allows for the use of an asset but does not convey any ownership rights of the asset.

What Is an Operating Lease?

Length of Agreement Often 6-12 months, but can be set for any length of time that two or more parties agree to in the lease. Managed By Property owner Tenant who pays rent to use the property Definition (Wikipedia) A lease is a contractual arrangement calling for the lessee to pay the lessor (owner) for use of an asset. Renting, also known as hiring or letting, is an agreement where a payment is made for the temporary use of a good, service or property owned by another.

Even though a capital lease is a rental agreement, GAAP views it as a purchase of assets if certain criteria are met. Unlike operating leases that do not affect a company’s balance sheet, capital leases can have an impact on companies’ financial statements, influencing interest expense, depreciation expense, assets, and liabilities. However, recognizing leases on the balance sheet at adoption is one thing; remaining compliant going forward is another. The calendar-year-end private company described above will be required to recognize its leases on the balance sheet on Jan. 1, 2021. This means that starting on Jan. 1, 2021, the entity should apply the new lease standard and other GAAP requirements to its existing leases and new leases.